How to Find an Investor for Your Business

Read time: 3-4 minutes

Introduction & Definitions of the Different Types of Investors

Raising capital is often cited as one of the more difficult exercises in business which is a fascinating paradox given how much of it is available to business owners. Globally, there is over $1 trillion of uninvested capital at the ready to be deployed, so why then is the process of finding an investor so challenging? To start, investors come in a variety of shapes and sizes, and there are a LOT of them to choose from.

Not to worry, we’re here to help. Like any good journey of understanding, it’s important to start by defining key terms to make sure you are clear on the characters you may encounter on your quest to find the right investor for you. Here are the most common categories of investors from which you can choose (no particular order):

| Description of Each Investor Type | |

|---|---|

| Passive investors offering debt in exchange for scheduled principal and interest repayments. This is the most risk averse category of investor who will want to see tangible collateral protecting their investment in the form of assets (e.g. Receivables, inventory, real estate) and/or personal guarantees. Capital from lenders can be used to fund growth / expansion, satisfy short-term cash needs and sometimes allow you to take money out of the business in the form of a dividend. | |

| High net worth individuals who have both the personal liquidity and risk appetite to make non-control investments into early stage companies. Alongside a founder, angels will often be some of the earliest equity capital into a business. Angels will come from various walks of life – in some cases they will have generated their wealth from entrepreneurial or other business pursuits, though they are likely to be passive investors. Angels are frequently part of angel networks that periodically congregate to source and evaluate early-stage investment opportunities. | |

| A professional source of early stage capital for founder-led businesses that show strong upside potential. Venture capital firms (or, VCs) raise committed capital from Limited Partners and focus on businesses that are frequently pre-profitability (in some cases, pre-revenue). VCs typically invest in a larger portfolio of 20-40+ companies from their fund with the understanding that a mere 20% of their investments will produce 80% of their targeted returns. VCs are usually non-control investors, though many hail from entrepreneurial backgrounds and may be a good source of guidance given analogous experiences. | |

| Similar to how this definition is situated in this chart, growth equity investors exist somewhere between venture capital and private equity. Growth equity investors may pursue more traditional VC and/or PE-style deals, but the name generally implies that they are making non-control investments into later stage businesses. Because growth equity deals traditionally have less upside potential than VC deals, a growth equity investor will be less tolerant of investment losses and may seek more downside protection than some of the earlier stage investors profiled above. It would be common for a growth equity investment to be “structured”, meaning that their investment would be in the form of a preferred class of stock possessing features not offered to other shareholders (e.g. accruing dividends, liquidation preference, etc.). | |

| Another source of professional capital though for established, profitable businesses. Private equity (or, PE) investors raise funds from institutions (e.g. pension funds, endowments, insurance companies) to take controlling (51%+) ownership positions in companies generating positive EBITDA and with strong growth potential. In many cases, PE funds will encourage businesses owners to retain equity (or “rollover”) in the company to create shared interests in supporting future growth. PE investors will usually target a 2-3x return on their capital over a 3-5+ year investment period before seeking an exit. PE funds invest across a wide range of company sizes, though many “middle market” firms pursue founder or family-owned businesses valued at $100MM or less. | |

| Entities established by high net worth families to manage the wealth and investing activities of that family. Family offices are not mandated to deploy capital in the same way, say, a VC or PE fund might be and may be more selective in the investments they choose to make. This is especially true given that they are investing their own capital as opposed to capital raised from other sources. Further, family offices will often have longer investment horizons, meaning that they can invest in perpetuity in a business given that they won’t have external constituencies looking to generate near-term returns. Family offices can differ in their approach to managing investments in private companies but reputationally skew more passive in their approach. | |

| These firms are typically led by 1-2 newly minted MBAs that raise funding from high net worth individuals to identify a single acquisition target that they intend to run as CEO post-closing. Search funds frequently elevate recurring revenue services businesses in their list of acquisition criteria and prioritize finding a founder / owner seeking to transition out of the business to create room for the “search funders” to take control of the day-to-day operations. Note that search funds do not have authority over their investors’ capital in the way that a PE or VC fund might as General Partners. Rather, search funds need to present investment opportunities to their backers who then can approve or deny an acquisition. | |

| These groups will look and feel like private equity investors in many ways, though the primary distinction is that they do not have the capital to invest. Independent sponsors are frequently professionals that were previously affiliated with private equity funds and decided to set off on their own to source and structure deals to be funded by a third party. There are over 300 or so independent sponsor groups across the country, so it is an established population, but it’s important to know that if you agree on a deal, the next step will be for the independent sponsor to find someone to fund the transaction. Often times, independent sponsors shine in helping to identify hidden value in an opportunity where other investors passed. |

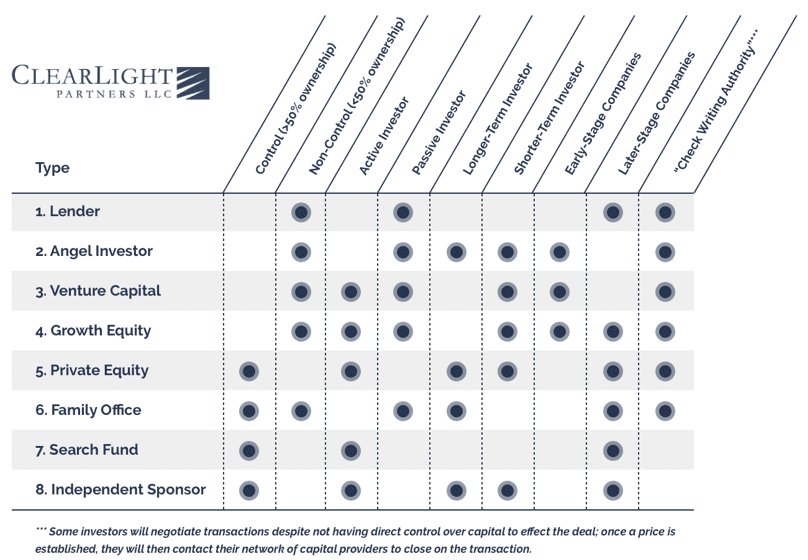

The many nuances of each investor type can be tough to commit to memory, so here’s a chart that visually summarizes the key distinctions between the various groups:

Step 1: Determine the Type of Investor You Need

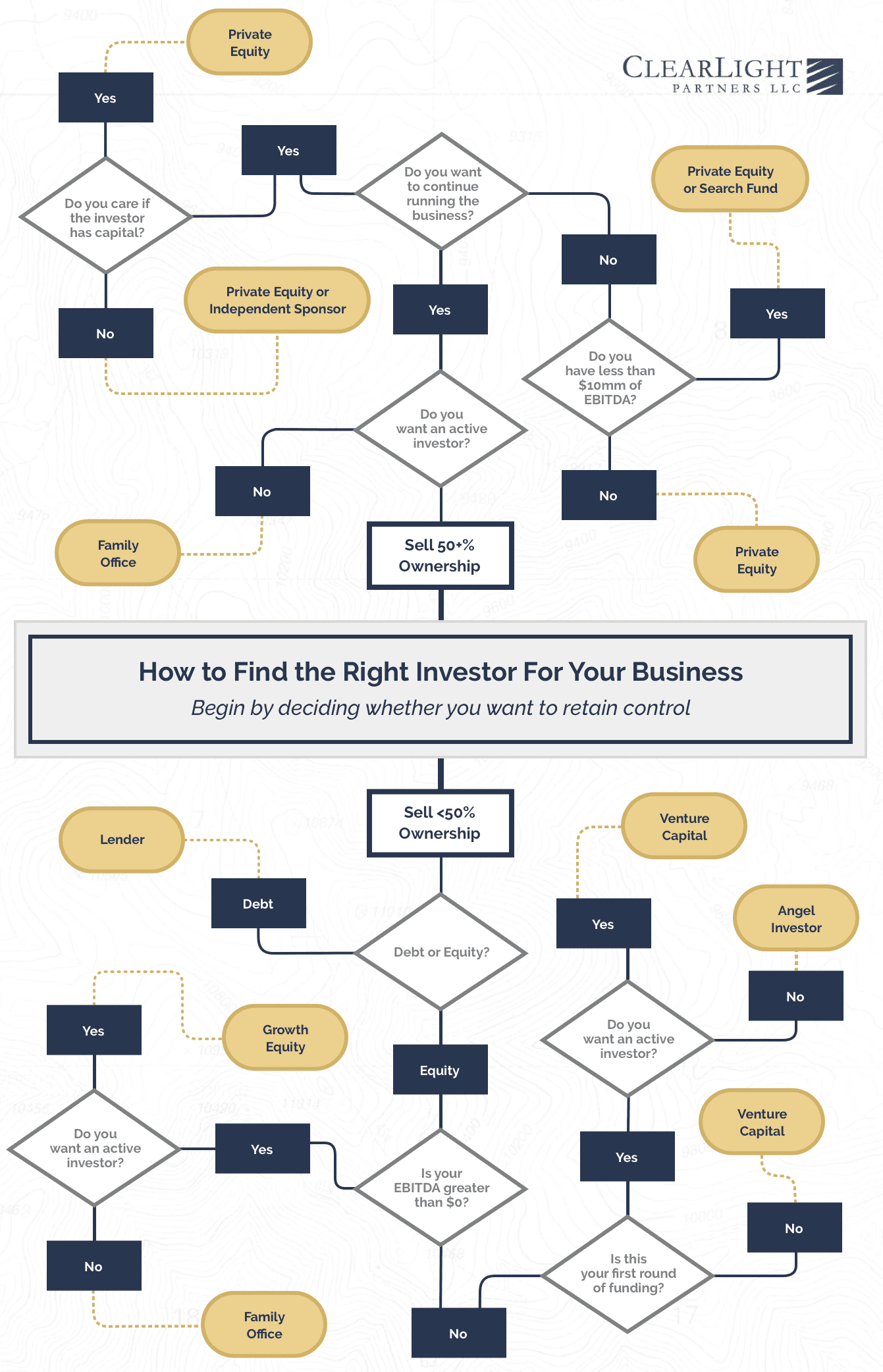

They say a picture is worth a thousand words, so I figured the flow chart below would be a more efficient way to help you determine the type of investor that is appropriate for your business. Once you know what you’re looking for, you can proceed to “Step 2” for instructions on how to build your contact list.

Step 2: Build a Contact List

So, now you know the type of investor you’re looking for. Here are the information resources you will want to check out to build a list of firms to reach out to:

| Information Resource | |

|---|---|

|

It may seem a little too obvious, but Google can be an excellent way to find the type of investor you’re looking for. This is because the more sophisticated investors in each category will have invested in developing a digital presence such that they are easy to find. Give it a shot, you’d be surprised with how many firms you can identify this way. |

|

While the majority of LinkedIn connectivity is person to person, you can search for keywords that may help highlight potential investors for your business. An added benefit is that you’ll also be able to quickly identify any connections (1st, 2nd, 3rd degree) to groups that pop up in your search. |

|

Pitchbook is a subscription information platform frequently used by investors and companies alike. The user interface is highly intuitive, and they frequently make feature updates that make it ever more powerful as a search tool. Start by requesting a free trial – this may be enough to build your initial list or you may find value in becoming a subscriber. |

|

This is another business information platform centered around companies and investors. It offers a searching tool that allows you to filter their database of thousands of contacts and home in on the types of groups and people you are looking for. Similar to Pitchbook, certain features require a subscription, but you can access a free trial. |

Step 3: Reach Out to Your List of Contacts

Each category of investor has their own distinctions in terms of the types of companies / situations in which they invest and, similarly, the way you get in touch with each of them is also nuanced. So, once you have your contact list in hand, here’s how to get in touch with each type of investor directly. Please note, though, that a warm intro into someone at a firm in which you are interested will always be preferable to a cold outreach. This guide is simply to point you in the right direction if you can’t get such an intro.

| How to Get in Touch with Each Type of Investor | |

|---|---|

| Lenders will frequently employ business development officers (BDOs) whose primary job is to identify commercial lending opportunities. These professionals are compensated based on their ability to surface leads, so they should respond ASAP to any inbound inquiries. Look for titles on their websites that sound like “business development” or “relationship manager”. | |

| Most angel networks have a website that will tell you how to contact their members or the broader organization. One option is to apply for funding through a general submission form, the other is to identify higher ranking members of the network and reach out to them directly via email or LinkedIn. | |

| VCs tend to have fairly aggressive investment sourcing processes, so they should be relatively easy to get a hold of if you have a promising business. Like banks, many VCs have professionals solely focused on deal origination, so those professionals may be a good starting point. Shoot them an email and see what you hear back. However, make sure the firm’s sector focus areas align with what your business does to improve your response hit rate and reduce any wasted time. If that doesn’t work, review their team’s bios to see whose entrepreneurial experiences may align with yours – if they deem you to be a kindred spirit, that should yield a response. | |

| Many growth equity investors have dedicated deal sourcing teams, so this is a good place to start. Scan through the bios and look for language that references “sourcing” or “business development”. If not, start at the top of the org chart and work your way down until you get a response. Persistence should pay off even if it takes a few followup attempts. | |

| Same as growth equity & VCs, it’s common for PE funds to have dedicated deal sourcing professionals. Insofar as it’s these individuals’ jobs to identify new investment opportunities, they will be happy to hear from you. Look for titles with the words “Investment Development”, “Business Development”, “Deal Sourcing”, or “Origination” in them. As with other professional investment firms, make sure their investment criteria aligns with your business in terms of industry and the amount of EBITDA you are generating. | |

| Good luck. There’s a saying, “If you’ve met one family office, you’ve met one family office.” All that means is that “family office” can mean a lot of different things and getting through to the decision maker can be a real challenge. To improve your odds, look for family offices that advertise investment activity of the variety that your business presents. In other words, if a family office has made all of their money in real estate and seems to focus within that asset class, it may not be worth approaching them about your manufacturing business. Your best bet is to start at the top and work your way down. If you can’t get a response from the head of the office, many of these groups have a Chief Investment Officer or CFO that may be a good starting point. | |

| The good news about search funds is that they are run by 1-2 people whose sole purpose is to find a business to buy, so they will be highly motivated to respond to your call email. Of every investor type profiled here, a search fund will be relatively more likely to respond to a cold call or email. Plus, they spend most of their time sending out emails and letters to prospective targets, so someone seeking to have a conversation about a deal will be most welcomed. | |

| Similar to search funds, independent sponsors spend most of their time hunting for new investment opportunities. In the rare instance that a business owner actually calls them, they will be highly likely to return the call. Your best bet is to reach out to the founder directly. Just make sure to probe on their network of capital sources because they won’t directly control the capital needed to close on a transaction with you. |

Conclusion

I realize that was a lot of information, but hopefully you’re now armed with knowledge about the type of investor your need, how to build a list of contacts and best practices in reaching out to each type of investor directly. As always, we’re here to help, so please reach out to start a conversation.

About ClearLight Partners

ClearLight is a private equity firm headquartered in Southern California that invests in established, profitable middle-market companies in a range of industry sectors. Investment candidates are typically generating between $4-15 million of EBITDA (or, Operating Profit) and are operating in industries with strong growth prospects. Since inception, ClearLight has raised $900 million in capital across three funds from a single limited partner. The ClearLight team has extensive operating and financial experience and a history of successfully partnering with owners and management teams to drive growth and create value. For more information, visit www.clearlightpartners.com.

Disclaimer: The views and opinions expressed in this blog are solely my own and do not necessarily reflect any ClearLight opinion, position, or policy.